Soybean Seasonality: Does a Pattern Exist?

Seasonal trends can be a powerful tool in grain marketing—if they exist. Continuing my previous blog on corn seasonality, I wanted to analyze soybean data to see if any reliable trends emerge. If you haven’t read the corn seasonal post, I suggest doing that first, as I walk through how I set up the data and why it matters. Here’s the link: Corn Seasonality.

Analyzing 20 Years of Soybean Trends

The first chart examines the median values over the past 20 years for November soybeans. I prefer using median values to avoid skewing from outlier years. Here’s what stands out:

Prices fluctuate between 98% and 102% for most of the year.

A period of elevation occurs from early May through July.

A dip appears from late September through October, which aligns with the harvest timeframe.

Overall, I don’t see a clear seasonal pattern in soybeans like I do in corn.

20-Year Median Trends

Breaking Down Trends Across Different Timeframes

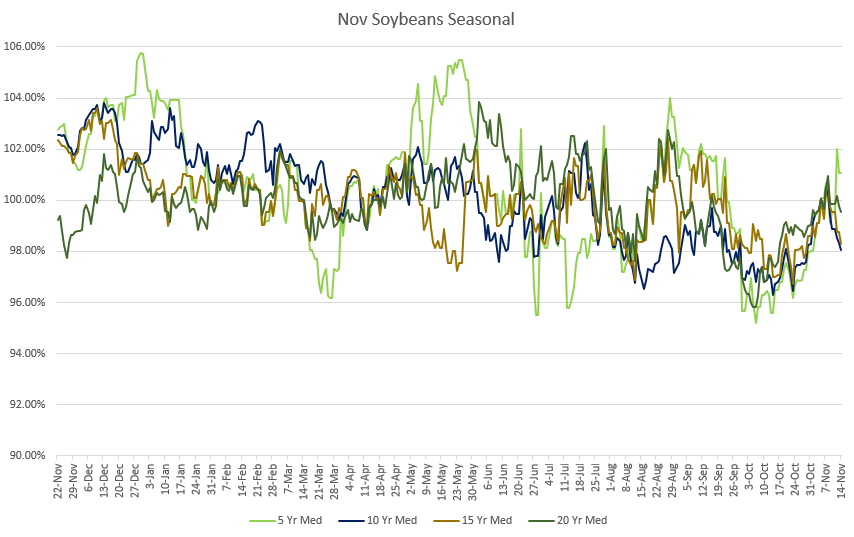

The next chart compares median values over 5, 10, 15-, and 20-year periods. This one is messier, making it harder to identify a clear trend. Here are my key takeaways:

The 5-year median fluctuates the most, which is expected with a smaller sample size.

Across all timeframes, there isn’t a distinct pattern that would inspire confidence in marketing decisions.

A Shift in Seasonality? Comparing 2005-2014 vs. 2015-2024

The final chart, which I find most significant, compares two key periods: 2005-2014 vs. 2015-2024. These past 10 years have been particularly volatile, with factors such as tariff trade wars and record-breaking South American production impacting the market.

Here’s what stands out:

The lines barely overlap, suggesting that seasonality may be shifting or has already changed.

Forward contracting in November or December, a year in advance, has been above the yearly median value more than half the time going back to 2015.

Data from the past decade suggests that selling before March 1st tends to result in a better price.

With planting and summer weather uncertainties, committing to early sales can be challenging. However, data shows that early sales have played a significant role in past market trends.

Final Thoughts

To wrap things up, soybean seasonality isn’t as convincing as it is in corn. The last 10 years look vastly different from the decade prior, which means marketing strategies may need to adapt. The summer window has become less reliable while early sellers have been rewarded.

Until South American production stabilizes, identifying a consistent seasonal trend may remain challenging. Market conditions will likely continue to fluctuate, requiring close attention to emerging patterns.

Casey Christianson

Quantitative Analyst | CODAK Market Advisor, Northern Plains

With a background in advanced mathematics and statistics, Casey’s expertise helps CODAK increase objectivity, speed, and precision in risk management decisions, driving greater client profitability.

Connect with Casey